FOR INVESTORS, IT IS ALL ABOUT KEEPING THE RISK AS LOW AS POSSIBLE, EVEN IF THEY ARE OPERATING IN THE FIELD OF VENTURE CAPITAL!

Risk mitigation:

A DD is used to assess potentials and risks. Risks that play a role in a tech DD are, for example, problems in the software architecture or problems with licenses. The potential lies in the team’s ability to deal with them adequately: Are the team aware of the problems? Do they know how to fix the problem? So the two are not looked at in isolation, but the point is that risks are transparent to the investor:ins and they get a sense of whether the team is up to these challenges, and how big these challenges will be.

Confidence-building measure:

The DD checks whether what was presented in the pitch and in the documents matches the actual (technical) implementation and thus builds trust with the Investor:in.

Legal risks and pitfalls:

Consideration is given to whether legal risks exist or are considered in the implementation of the idea.

Opinion of trusted partners:

An independent party, usually a partner trusted by the Investor:in due to their expertise, assesses the team, the idea and the market opportunities. This provides additional security to ensure the investment. An investor:in acts primarily on behalf of a fund or other funders:in. She must therefore be able to represent her decisions to her backers.

Technical expertise from trusted partners:

Investor:s seek external expertise for a DD to ensure that they have a sound understanding of the start-up’s business and technology. The DD is designed to identify risks, uncover opportunities, and ensure that the startup is capable of achieving its intended outcomes. An independent party performing DD provides an objective view and expertise that the investor:in may not have.

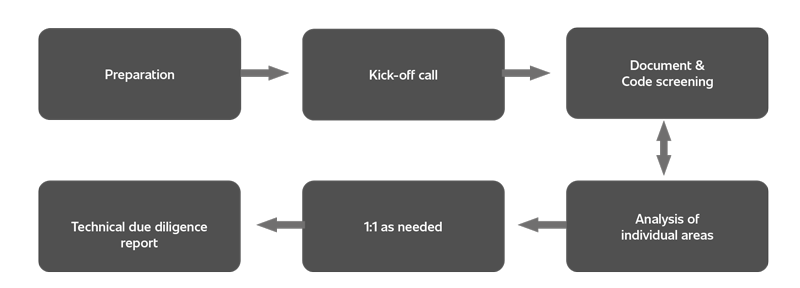

Technical Due Diligence Stages: